TORONTO, ONTARIO, October 3, 2024 – Greater Toronto Area (GTA) home sales increased year-over-year

in September. Buyers were starting to take advantage of more affordable market conditions brought

about interest rate cuts and lower home prices.

“As buyers take advantage of changes to mortgage lending guidelines and borrowing costs trend lower,

home sales will steadily increase about population growth. With every rate cut, a growing number of

GTA households will afford a long-term investment in home ownership, including first-time buyers,” said

Toronto Regional Real Estate Board (TRREB) President Jennifer Pearce.

GTA REALTORS® reported 4,996 home sales through TRREB’s MLS® System in September 2024 – up by

8.5 percent compared to 4,606 sales reported in September 2023. New listings entered into the MLS®

System amounted to 18,089 – up by an even greater 10.5 percent year-over-year. On a seasonally adjusted

basis, September sales increased every month compared to August, along with new listings.

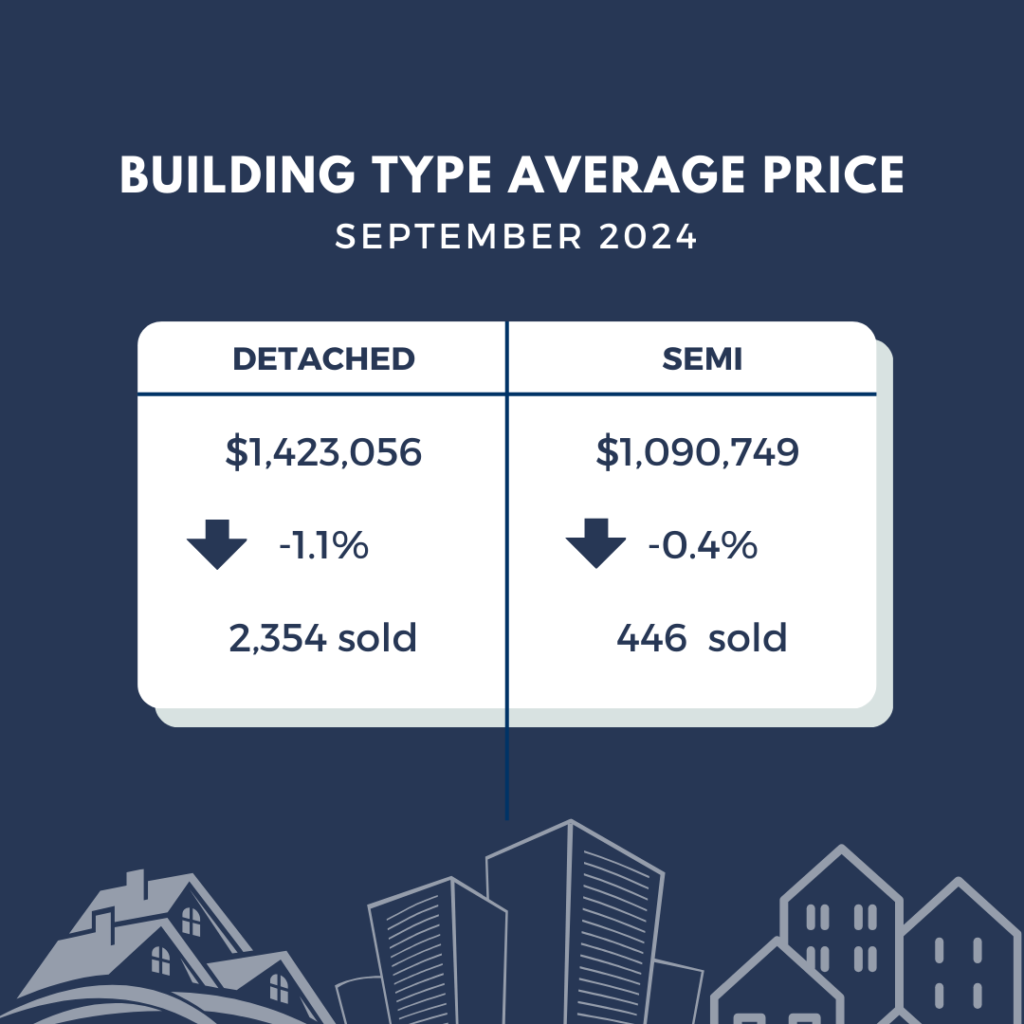

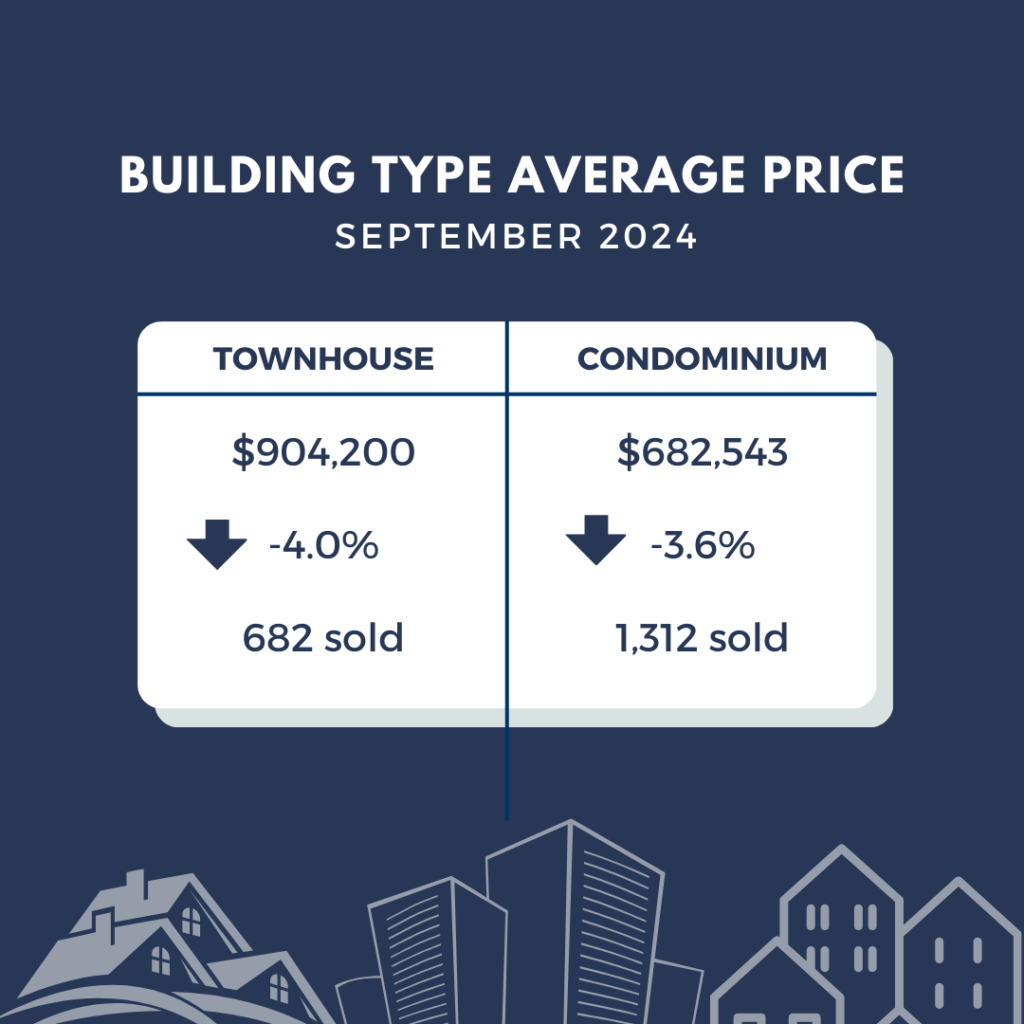

The MLS® Home Price Index Composite benchmark was down by 4.6 percent year-over-year in September

The average selling price, at $1,107,291 was down by a lesser one percent compared to the

September 2023 average of $1,118,215. On a seasonally adjusted basis, the average selling price edged up

slightly compared to August.

“The annual improvement in September home sales was more than matched by the increase in new listings

over the same period. This resulted in a better-supplied market and increased negotiating power for buyers

re-entering the market. The ability to negotiate on price, led to moderate year-over-year price declines,

particularly in the more affordable condo apartment and townhouse segments, which are popular with

first-time buyers,” said TRREB Chief Market Analyst Jason Mercer.

“We are pleased with the positive changes to mortgage lending guidelines announced over the past month.

The ability for existing mortgage holders to shop around for the best rate without facing the stress test will

result in more affordable renewals. Longer amortization periods and the ability to insure mortgages for

purchases over 1 million dollars will give home buyers more options as the GTA housing market recovers.

TRREB has long been calling for these changes to give buyers more flexibility as they navigate their home

buying journey,” said TRREB CEO John DiMichele.